In addition to assisting first home buyers, we also administer other initiatives to help Victorians buy or build their own homes.

Concessions for home buyers

Pensioner exemptions and concessions

This year, 4,891 pensioners accessed the specific exemptions and concessions available to them to buy their own homes, totalling $55.5 million in savings.

Principal place of residence concessions

The principal place of residence (PPR) concession supports Victorians who buy their own home. This concession is available to those buying a property valued up to $550,000 and who move into their home within 12 months of settlement.

In 2022–23, 13,362 people accessed this concession, leading to total customer savings of $31.0 million.

| PPR concessions | Number | Value ($M) |

|---|---|---|

| Metropolitan Melbourne | 5,649 | 13.6 |

| Regional Victoria | 7,713 | 17.4 |

| Total | 13,362 | 31.0 |

Australian HomeBuilder Grant

We also administer the HomeBuilder Grant on behalf of the Australian Government. Applications for this grant closed on 14 April 2021, but the deadline to submit supporting documentation for existing applications has been extended to 30 June 2025.

Throughout 2022–23, we continued to manage the delivery of these grants to successful applicants. There have been 2,657 successful applications, providing $54.4 million in grants in total.

Victorian Homebuyer Fund

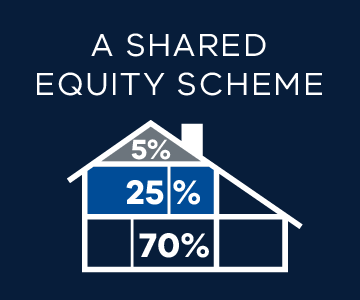

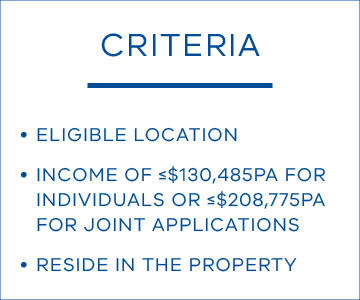

The Victorian Homebuyer Fund (VHF) is a shared equity scheme which makes it easier for Victorians to achieve home ownership. The VHF allows eligible participants to work with a lender to buy a house sooner without the burden of saving a large deposit.

If you have a 5% deposit, the Victorian Government can contribute up to 25% of the purchase price in exchange for an equivalent share in the property. This will save you money by reducing your mortgage and removing the need for Lenders Mortgage Insurance.

Aboriginal and Torres Strait Islander participants only require a 3.5% deposit and are eligible for a 35% shared equity contribution.

The VHF has now assisted 4,400 single or multi-person households to purchase a home since it was launched in October 2021.

In 2022–23:

- There were 2,874 successful applications and 2,702 settled properties with total shared equity of $407 million.

- We processed 99% of applications within 5 days.

- The median purchase price was $605,000.

- 40% of participants were aged 25 to 34.

- Single participants made up 51% of purchases, while multi-person households (mainly couples) made up 49%.

- 87% of settled properties were in metropolitan Melbourne, while 13% were in regional Victoria.

Plus, 210 applications with total original shared equity of $4.5 million have been transferred from the HomesVic pilot program to the VHF.